To see specific content and invest in american projects on DIVI•hub, click on the button "Go to DIVI•hub USA".

Regulation Crowdfunding Educational Information

Introduction

The SEC requires DIVI•hub to post educational materials for prospective investors on its site. These materials are a great start to educate yourself and understand the risks of making crowdfunding investments. However, there are several additional steps you must take to make a responsible investment decision, including completion of a thorough investigation of the issuing company and participation in our online forum.

The online forum allows you to ask the issuing company questions, interact with other investors, and study the benefits, detriments, and risks of each investment opportunity.

Equity crowdfunding allows the general public to participate in venture capital and private equity investing. Companies can use crowdfunding to offer and sell securities to the investing public – anyone can invest in a crowdfunding securities offering.

Rule 302(b)

Pursuant to Rule 302(b) of Securities and Exchange Commission (“SEC”) Regulation Crowdfunding under the Securities Act of 1933 (Title III of the JOBS Act), as amended (the “Securities Act”), it is required that all potential investors who open an account on DIVIhub.com and/or commit to purchasing securities receive and acknowledge certain educational information from DIVI·hub related to the posting of securities offerings on the DIVI·hub platform, including:

Investing Process Under Regulation CF

To invest in securities offered under Regulation CF on DIVI·hub, download the DIVI·hub Application, choose the project/issuer desired to invest in and simply tap on the “Invest” button. You will be asked to confirm that you have reviewed these educational materials and understand the risks of securities investing as disclosed on the profile page DIVI·hub’s Website and Application have a “Risk Notice”. Once you acknowledge the materials, you will be redirected to our investment flow and provide important information to help DIVI·hub complete your investment. Upon confirming your investment, your investment amount will be funded and held in escrow or an escrow-like account at a third-party agent.

Investors are allowed to cancel their investment at any time up to 48 hours before a closing. In the event the target offering amount is reached prior to the offering deadline, all investors that have confirmed their investment by completing the investment flow on DIVI·hub will be notified five business days prior to the new closing date, which is meant to give investors adequate time to cancel their investment.

Lastly, in the case that the Issuer has a material change in their offering (e.g., terms are updated, company operations have materially changed), all investors will receive a notice of that material change and are required to confirm their investment. In the case that the investor does not confirm their investment within five business days, their investment will be automatically canceled, and the funds committed and placed in escrow will be returned to the investor.

The Types of Securities Offered and Sold

DIVI·hub will provide two offering models: Equity Crowdfunding and Revenue Share Crowdfunding. The offering model/type is contingent on what is best for the issuer and its investors.

- Equity Crowdfunding: Equity Crowdfunding is a method of raising capital online from investors in order to fund a private business or projects(s). In return for cash, investors receive equity ownership in the business and dividends of the profits. This method is an example of an equity model of investing.

- Revenue Share Crowdfunding: Revenue Share Crowdfunding is a debt instrument whereby the content creator, company etc. raising capital online from investors in order to fund a private business or projects(s). In return for cash, investors receive interest payments from the content creator, company etc. and their initial investment. This method is an example of a debt model of investing.

The Restrictions on The Resale Of Reg CF Platforms

Pursuant to Regulation Crowdfunding Rule 501:

- Securities issued in a transaction exempt from registration pursuant to section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)) and in accordance with section 4A of the Securities Act (15 U.S.C. 77d-1) and this part may not be transferred by any purchaser of such securities during the one-year period beginning when the securities were issued in a transaction exempt from registration pursuant to section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)), unless such securities are transferred:

- To the issuer of the securities;

- To an accredited investor;

- As part of an offering registered with the Commission; or

- To a member of the family of the purchaser or the equivalent, to a trust controlled by the purchaser, to a trust created for the benefit of a member of the family of the purchaser or the equivalent, or in connection with the death or divorce of the purchaser or other similar circumstance.

- For purposes of this § 227.501, the term accredited investor shall mean any person who comes within any of the categories set forth in §230.501(a) of this chapter , or who the seller reasonably believes comes within any of such categories, at the time of the sale of the securities to that person.

- For purposes of this section, the term member of the family of the purchaser or the equivalent includes a child, stepchild, grandchild,parent, stepparent, grandparent, spouse or spousal equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the purchaser, and shall include adoptive relationships. For purposes of this paragraph (c), the term spousal equivalent means a cohabitant occupying a relationship generally equivalent to that of a spouse.

- Securities issued in a transaction exempt from registration pursuant to section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)) and in accordance with section 4A of the Securities Act (15 U.S.C. 77d-1) and this part may not be transferred by any purchaser of such securities during the one-year period beginning when the securities were issued in a transaction exempt from registration pursuant to section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)), unless such securities are transferred:

Disclosure by Issuers Under Regulation CF

An issuer that has offered and sold securities in reliance on section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)) must file with the Commission and post on the issuer's Web site an annual report along with the financial statements of the issuer certified by the principal executive officer of the issuer to be true and complete in all material respects and a description of the financial condition of the issuer as described in § 227.201(s).

An issuer must continue to comply with the ongoing reporting requirements until one of the following occurs:

- The issuer is required to file reports under section 13(a) or section 15(d) of the Exchange Act (15 U.S.C. 78m(a) or 78o(d));

- The issuer has filed, since its most recent sale of securities pursuant to this part, at least one annual report pursuant to this section and has fewer than 300 holders of record;

- The issuer has filed, since its most recent sale of securities pursuant to this part, the annual reports required pursuant to this section for at least the three most recent years and has total assets that do not exceed $10,000,000;

- The issuer or another party repurchases all of the securities issued in reliance on section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)), including any payment in full of debt securities or any complete redemption of redeemable securities; or

- The issuer liquidates or dissolves its business in accordance with state law.

Each investor in a Reg CF must calculate his or her net worth. All assets are totaled, and all liabilities are subtracted from that total. For crowdfunding, the value of the investor’s primary residence is not included in the net worth calculation. The SEC’s Investor Bulletin Crowdfunding for Investors contains detailed and useful information about how to perform these calculations.

Investor Limitations

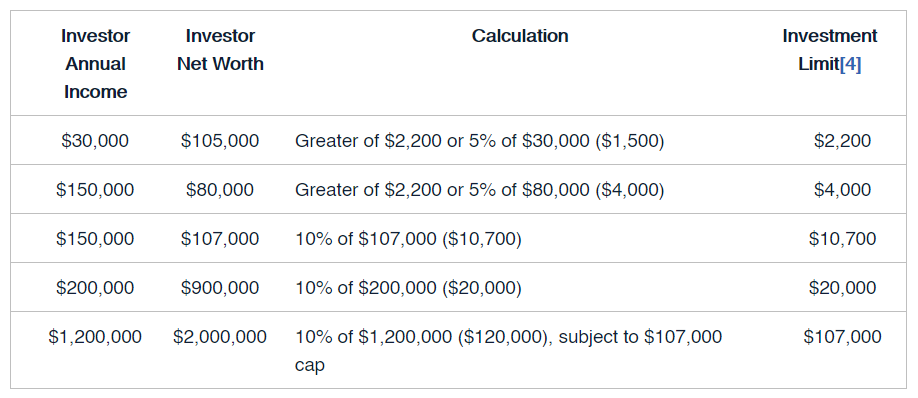

Because of the risks involved with this type of investing, you are limited in how much you can invest during any 12-month period in these transactions. The limitation on how much you can invest depends on your net worth and annual income. If either your annual income or your net worth is less than $5,000,000, then during any 12-month period, you can invest up to the greater of either $2,200 or 5% of the greater of your annual income or net worth. If both your annual income and your net worth are equal to or more than $107,000, then during any 12-month period, you can invest up to 10% of annual income or net worth, whichever is greater, but not to exceed $107,000 for all crowdfunding offerings in any 12-month period. Investors who qualify as accredited investors do not have an annual limit.

Annual Income Net Worth Calculation 12-month Limit $30,000 $40,000 greater of $2,200 or 5% of $40,000 ($2,000) $2,200 $150,000 $80,000 greater of $2,200 or 5% of $150,000 ($7,500) $7,500 $150,000 $107,000 10% of $150,000 ($15,000) $15,000 $175,000 $900,000 10% of $900,000 ($90,000) $90,000 Right to Cancel

Investors are allowed to cancel their investment at any time up to 48 hours before a closing.

In the event the target offering amount is reached prior to the offering deadline, all investors that have confirmed their investment by completing the investment flow on DIVI·hub will be notified five business days prior to the new closing date, which is meant to give investors adequate time to cancel their investment.

If the issuer makes a material change to the offering terms (e.g., the total amount of the offering, the type of security, etc.) or other information disclosed to investors, including if the deadline is extended, each investor will be given five business days to reconfirm his or her investment commitment. If the investor does not reconfirm, their investment will be canceled, and their funds will be returned. In addition, if the issuer makes a material change an amendment must be filed with the SEC.

Considerations for Investors

DIVI·hub and its employees are prohibited from offering advice about any offering posted on DIVI·hub and from recommending any investment. No SEC review is involved in Regulation Crowdfunding offerings. The decision to invest must be based solely on the investor’s own individualized consideration and analysis of the risks involved in a particular investment opportunity posted on the DIVI·hub.

Potential investors acknowledge and agree that they are solely responsible for determining their own suitability for an investment or strategy on DIVI·hub and must accept the risks associated with such decisions, which include the risk of losing the entire amount of their principal. Investors must be able to afford to lose their entire investment.

DIVI·hub has no special relationship with, or fiduciary duty to potential investors, and investors’ use of the funding portal does not create such a relationship. Potential investors agree and acknowledge that they are responsible for conducting their own legal, accounting, and other due diligence reviews of the investment opportunities posted on DIVI·hub.

Completion of an Offering

Following the completion of an offering conducted DIVI·hub, there may or may not be an ongoing relationship between the issuer and intermediary.

An Issuer May Cease To Publish Annual Reports

The SEC declined to develop its own investor educational materials for the purpose of this requirement, instead leaving it to each platform to determine the best means to educate their investors. These educational materials must be made continuously available. Should the intermediary make material revisions to its educational materials, it must provide the updated materials to all investors prior to accepting any additional investment commitments or effecting any further transactions.

Investment Limits

DIVIHUB USA, LLC: is a FINRA licensed investment banking platform that connects issuing companies with investors, including through equity crowdfunding.

- Enacted in 2016 and significantly expanded in 2021

- $5 million per year

- Light disclosure required

- Anyone (including non-accredited investors) can invest

- General solicitation/advertising permitted (subject to restrictions)

Form C

Prior to launching a Section 4(a)(6) equity crowdfunding campaign, the issuer is required to complete and submit a Form C to the SEC together with required attachments. Companies that file a Form C are required to disclose certain information to the public which can be used to understand an investment and that helps determine whether a particular investment is appropriate for a specific person. This includes general information about the issuer, its officers and directors, a description of the business, the planned use for the money raised from the offering, often called the use of proceeds, the target offering amount, the deadline for the offering, related-party transactions, risks specific to the issuer or its business, and financial information about the issuer.

Material Changes

If the issuer makes a material change to the offering terms (e.g., the total amount of the offering, the type of security, etc.) or other information disclosed to investors, including if the deadline is extended, each investor will be given five business days to reconfirm his or her investment commitment. If the investor does not reconfirm, their investment will be canceled, and their funds will be returned. In addition, if the issuer makes a material change an amendment must be filed with the SEC.

Annual Filing Obligation of Issuers

Each issuer that successfully completes a Title III Regulation Crowdfunding securities offering is required to annually file with the SEC a Form C-AR and financial statements. This must be done no later than 120 days after the end of the Issuer's fiscal year covered by such filing. Each Issuer must also post its Form C-AR and financial statements to its own website, and that link must be provided along with the date by which such report will be available on the issuer's website. The Form C-AR contains updated disclosure substantially similar to that provided in the issuer's initial Form C, including information on the issuer's size, location, principals and employees, business, plan of operations and the risks of investment in the Issuer's securities; however, offering-specific disclosure is not required to be disclosed in the Form C-AR. Investors should be aware that an issuer may no longer be required to continue its annual reporting obligations under certain circumstances. In the event that an issuer ceases to make annual flings, investors may no longer have current financial information about the Issuer available to them. An issuer must continue to comply with the ongoing reporting requirements until one of the following occurs:

(1) The issuer is required to file reports under section 13(a) or section 15(d) of the Exchange Act (15 U.S.C. 78m(a) or 78o(d));

(2) The issuer has filed, since its most recent sale of securities pursuant to this part, at least one annual report pursuant to this section and has fewer than 300 holders of record;

(3) The issuer has filed, since its most recent sale of securities pursuant to this part, the annual reports required pursuant to this section for at least the three most recent years and has total assets that do not exceed $10,000,000;

(4) The issuer or another party repurchases all of the securities issued in reliance on section 4(a)(6) of the Securities Act (15 U.S.C. 77d(a)(6)), including any payment in full of debt securities or any complete redemption of redeemable securities; or

(5) The issuer liquidates or dissolves its business in accordance with state law.

Audit

An audit provides a higher level of scrutiny by the accountant than a review. The required information is filed with the SEC and posted at the start of the offering on the DIVI•hub platform and available to the public throughout the offering on the DIVI•hub and SEC sites. It is available to the general public on both websites throughout the offering period - which must be a minimum of 21 days.

Reviewed Financials

A review of an organization's financial statements provides a report issued by a CPA which expresses that the financial statements are free from material misstatement. A review provides limited assurance on an organization's financial statements. During a review, inquiries and analytical procedures present a reasonable basis for expressing limited assurance that no material modifications to the financial statements are necessary; they are in conformity with generally accepted accounting principles.

GAAP Financials

All companies raising funds under Regulation CF must provide financial statements prepared in accordance with generally accepted accounting principles (GAAP). For companies incorporated over 120 days ago, GAAP financials must include a cover page, balance sheet, income statement, statement of cash flows, statement of stockholder's equity, and foot notes (typically 2 -5 pages including accounting methodologies used, an explanation of your taxes, a summary of any debt, and a summary of outstanding equity).

Calculating Net Worth

Each investor in a Reg CF must calculate his or her net worth. All assets are totaled, and all liabilities are subtracted from that total. For crowdfunding, the value of the investor's primary residence is not included in the net worth calculation. The SEC's Investor Bulletin Crowdfunding for Investors contains detailed and useful information about how to perform these calculations.

Cancellations/Changing Your Mind

Each investor has up to 48 hours prior to a rolling close, or 48 hours prior to the offering deadline, to change his or her mind and cancel the investment commitment for any reason. However, once the offering period is within 48 hours of ending, the investment may not be cancelled for any reason, even if the commitment is made during this period. Following the close on funds, the investor will receive securities in exchange for his or her investment. If the investment commitment is not cancelled 48 hours prior to the offering deadline or a rolling close, the funds will be released to the company by the escrow agent. If the investment commitment is cancelled before the 48-hour deadline, DIVI•hub will direct the return of any funds that have been committed.

Common Stock

Conveys a portion of the ownership interest in the company to the holder of the security. Stockholders are usually entitled to receive dividends when and if declared, vote on corporate matters, and receive information about the company, including financial statements. This is the riskiest type of equity security since common stock is last in line to be paid if a company fails. You should read our discussion of the risks of early-stage investing here, and pay special attention to the fact that your investment will only make money if the company's business succeeds. Common Stock is a long-term investment.

Preferred Stock

Stock that has priority over common stock as to dividend payments and/or the distribution of the assets of the company. Preferred stock can have the characteristics of either common stock or debt securities. While preferred stock gets paid ahead of common stock, it will still only be repaid on liquidation if there is money left over after the company's debts are paid. In certain circumstances (such as an initial public offering or a corporate takeover) the preferred stock might be convertible into common stock (the riskiest class of equity). You should review the terms of the preferred stock to know when that might happen.

Convertible Note

This form of investment is popular because it allows investors to initially lend money to the company and later receive shares if new professional investors decide to invest. The sort of convertible note that is most often offered on the DIVI•hub platform may limit the circumstances in which any part of the loan is repaid, and the note may only convert when specified events (such as a preferred stock offering of a specific amount) happens in the future. You will not know how much your investment is “worth” until that time, which may never happen. You should treat this sort of convertible note as having the same risks as common stock.

SAFE

Simple Agreement for Future Equity. The SAFE investor has the right to obtain equity when the company sells shares in a future financing, using a cheap and simple contract. SAFEs solve the difficult, time consuming, and expensive problem of valuing an early-stage startup, and documenting a priced equity investment. A SAFE is not a loan, does not have a legal obligation to be repaid, does not accrue interest, and does not have a maturity date.

Side by Side

A Side by Side offering refers to a deal that is raising capital under two offering types. For instance, a Side by Side offering may involve a raise under Regulation CF and Rule 506(c) of Regulation D.

Valuation Caps

The valuation caps reward early convertible note or SAFE investors. It sets the maximum price that your convertible security will convert into equity. To translate that into a share price, you divide the valuation cap by the series A valuation. Based on the valuation cap investors will be entitled to equity priced at the lower of the valuation cap or the pre-money valuation in the subsequent transaction.

Debt/Revenue Share

Securities in which the seller must repay the investor's original investment amount at maturity plus interest. Debt securities are essentially loans to the company and the major risk they bear is that the company does not repay them, in which case they are likely to become worthless.

Post-Money Valuation

The valuation of the company after a new investment. Calculated by adding the pre-money valuation and the amount of the new investment.

Pre-Money Valuation

The valuation of the company prior to a new investment. This does not include the amount of the new investment. The marketplace (supply and demand) determines the pre-money valuation of a private company.

Valuation

What the company is considered to be worth by the marketplace. Based on the valuation, percentage ownership can be calculated. The price per share of the stock, by itself, does not provide any meaningful information.

Restrictions on Resale

The securities offered on DIVI•hub are only suitable for potential investors who are familiar with and willing to accept the high risks associated with high risk and illiquid private investments. Securities sold through DIVI•hub are restricted and not publicly traded and, therefore, cannot be sold unless registered with the SEC or an exemption from registration is available. You are generally restricted from reselling your shares for a one year period after they were issued, unless the shares are transferred:

- to an accredited investor;

- to the company that issued the securities;

- as part of an offering registered with SEC;

- to a family member (defined as a child, stepchild, grandchild, parent, stepparent, grandparent, spouse or spousal equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships);

- in connection with the investor's death, divorce or similar circumstance;

- to a trust controlled by the investor, or a trust created for the benefit of a family member.

Benefits of a Reg CF for the issuer

- Quickly raise a significant amount of capital in an attractive structure

- Makes venture capital investing available to everyone - not just high-net worth individuals and institutions

- Like-minded people, clients, customers and friends can invest in your company

- Anyone can invest as little as $10 in your company (in denominations as little at $10)

- General solicitation: broadly advertise via email, digital advertising, in the press, or on social media - subject to regulatory compliance

- Entire raise can be consolidated into one or more SPVs(investors get the same economic exposure and information rights as they would from a direct investment in the company)

- You could have a massive crowd of rabid fans with a strong economic incentive to support you

Reg CF Requirements

- Quickly raise a significant amount of capital in an attractive structure

- Makes venture capital investing available to everyone - not just high-net worth individuals and institutions

- Like-minded people, clients, customers and friends can invest in your company

- Anyone can invest as little as $10 in your company (in denominations as little at $10)

- General solicitation: broadly advertise via email, digital advertising, in the press, or on social media - subject to regulatory compliance

- Entire raise can be consolidated into one or more SPVs(investors get the same economic exposure and information rights as they would from a direct investment in the company)

- You could have a massive crowd of rabid fans with a strong economic incentive to support you

Reg CF Requirements

- All Reg CF offerings must be made through a FINRA licensed broker/dealer like DIVI•hub or a funding portal

- Form C (a relatively simple information/disclosure document) must be filed with the SEC along with other items including past fundraising rounds, number of employees, large stakeholders, officers & directors, use of funds, material risks, etc.

- Any statements made to the public (including on LinkedIn, Twitter, Facebook, etc.) before Form C is filed must include required disclosures, and a screenshot of each of statement must be filed with Form C

- Advertisements must direct potential investors to the DIVI•hub landing page for the offering, be factual, complete, and avoid “forward looking information”, projections, hyperbole, misleading information, or omission of important information

- Advertisements cannot include the terms of the offering (use of funds, amount of securities offered, price and nature/type of the securities, closing date, status towards fundraising goal, etc.)

- The SEC requires periodic fundraising progress updates on Form C-U and any amendments to the offering statement on Form C/A

- Company financials must include revenues, cost of goods, taxes paid, net income, assets, cash, accounts receivable, short-term debt and long term debt

- Investment limits are calculated from self-reported income and net worth, and previous amounts invested across all Regulation CF offerings

- Two years of GAAP financials - must be reviewed by an independent CPA (audited financials are required for raises above $1.07 million). If the company was incorporated over six months ago and is raising over $1.07 million two years of GAAP format financials and an Independent Auditor's Report are required. DIVI•hub can introduce you to CPAs and legal/regulatory firms that are well-versed in Reg CF offerings, perform efficiently and quickly, and charge reasonable fees - or you may choose your own professionals

- Company must wait 21 days after Form C is filed to withdraw funds

- One year after closing, the company must file an annual report to update investors (includes a business discussion and CEO self-certified financial statements - no review or audit is required)

Frequently Asked Questions

- What is the Investment Process on DIVI•hub? You must open an account in order to invest, to commit to an investment or to communicate on the DIVI•hub platform. This requires that you provide certain personal and non-personal information to DIVI•hub and its affiliates and/or service providers, including information related to your income and net worth, and other investments. This information is used to verify you as a potential investor who is qualified to invest in investment opportunities posted on DIVI•hub. For further information regarding the handling of your personal information, please see the DIVI•hub Privacy Policy.

- How much can an individual invest in a Reg CF transaction? Anyone can invest in offerings under Regulation Crowdfunding. Because of the risks involved with this type of investing, however, you are limited in how much you can invest during any 12-month period in these transactions. The limitation on how much you can invest depends on your net worth and annual income. Accredited investors have no limit on how much they can invest.

- Do investors pay fees? DIVI•hub receives fees based on a percentage of each investment made by each investor on the platform. The fee schedule is subject to change at any time and is disclosed in the offering document of the company.

- How Does DIVI•hub Get Paid? DIVI•hub makes money by charging a commission on the amount of investments raised by the issuer. This is subject to change at any time and is disclosed in the offering document of the company. The commission is usually a percentage of the capital raised, and usually is comprised of a cash fee and an equity fee.

- Can Regulation Crowdfunding Securities Purchased Directly from a Company be Purchased Directly from a Company No. Companies may not offer crowdfunding investments to directly. They must use a crowdfunding intermediary, such as a Financial Industry Regulatory Authority (FINRA) broker-dealer like DIVI•hub or a funding portal. Each must be registered with the Securities Exchange Commission and FINRA.

- What Proof of Ownership does the Investor receive? The offering is “Book Entry” - this will operate as the proof of purchase. Electronic records will be held with the issuing company's transfer agent or cap table management service. Once the purchase of stock is complete, the investor will receive a confirmation email with details of the investment which will include a Subscription Agreement countersigned by the issuing company.

- What If the Target Investment Goals are Reached by the Issuing Company Early? When the target offering amount has been met DIVI•hub will notify investors by email. If the issuing company obtains its goal early, it can create a new target deadline at least five business days out. Investors will be notified of the new target deadline via email. Investor will then have the opportunity to cancel up to 48 hours before the new deadline. Regardless of their progress in meeting their funding target, campaigns must be live for a minimum of 21 days.

- What Ways Can I Invest? On the DIVI•hub platform you can invest: individually.